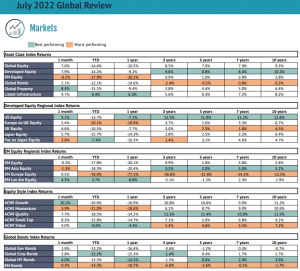

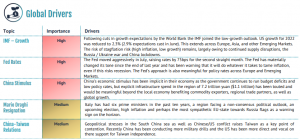

July once again saw high inflationary prints across developed markets, this in turn sustained the hawkish approach adopted by the central banks in these regions. Despite this the market view developed that inflation may be easing and subsequently central banks (especially the Federal Reserve) do not need to be as aggressive as previously thought. Lower inflation expectations were however met with lower growth expectations too.

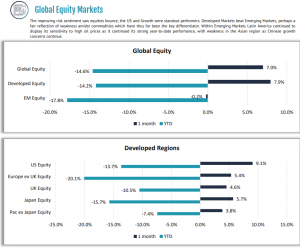

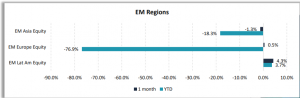

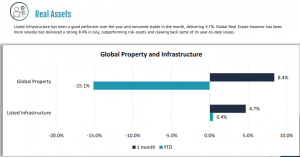

The improving risk sentiment off low levels drove positive returns for Equities and Listed Property and helped to compress credit spreads as High Yield and Corporate debt outperformed. Commodities and Emerging Markets lagged over the month.

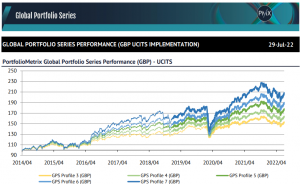

GLOBAL ASSET CLASS DETAILS