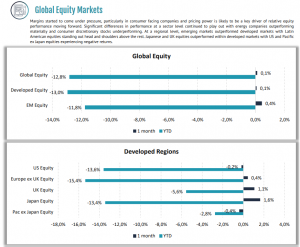

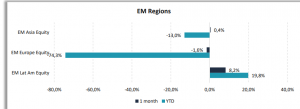

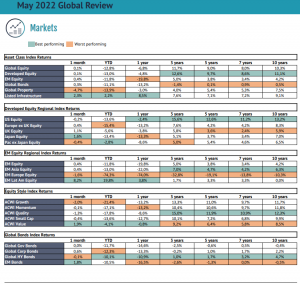

Although the global equity market ended the month relatively flat there was significant intra-month volatility as markets initially fell 6% to mid-May, only to recover this by the end of the month. The key macro risks of war in Ukraine, tightening monetary policy and Covid restrictions in China remain, and markets lacked a clear catalyst for a change in sentiment. In an environment dominated by fears of recession or runaway inflation, heightened volatility has become the norm with severe market reactions playing out at a company level. Central banks are continuing to grapple with inflation. But they are now even more conscious of rising growth risks, which remain higher in Europe than the US. Labour markets remain tight but with real wage growth negative the squeeze on consumers remains. The slight uptick in global equity markets was accompanied by positive global bond returns, however commodities remained the strongest asset class.

GLOBAL ASSET CLASS DETAILS